Conclusions:

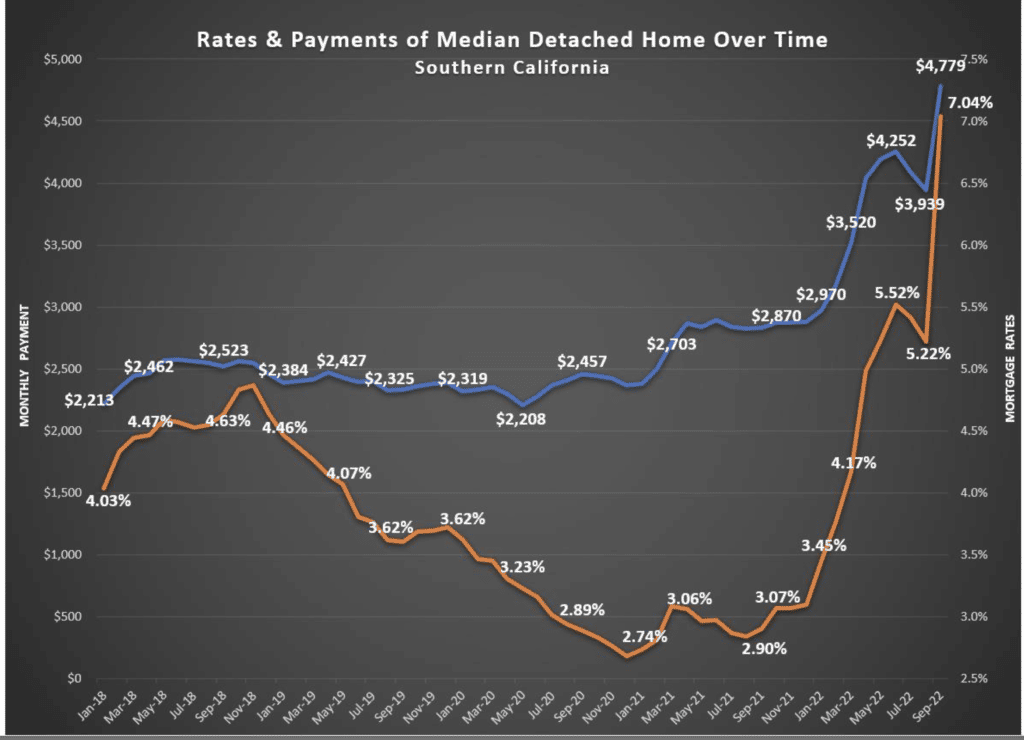

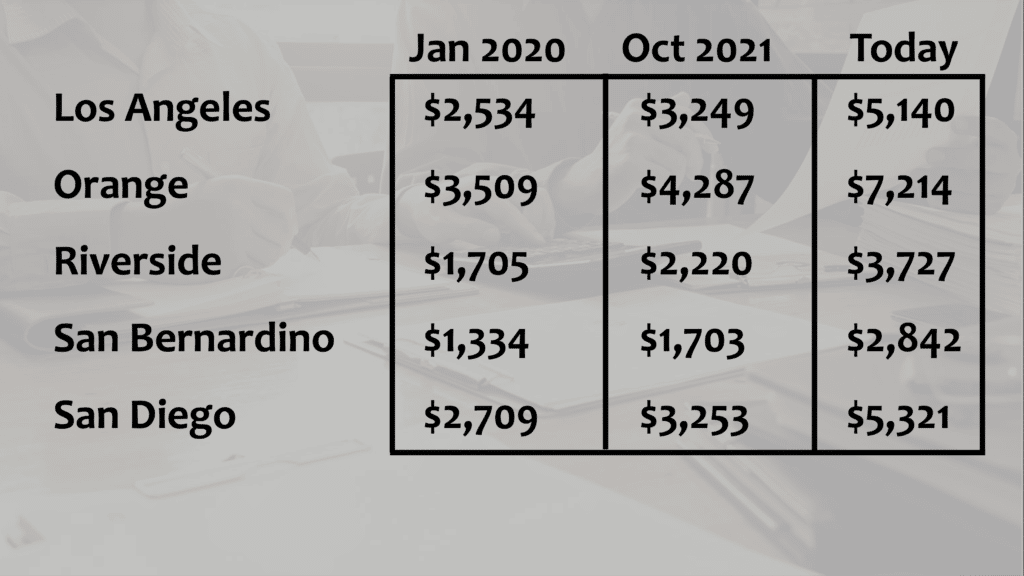

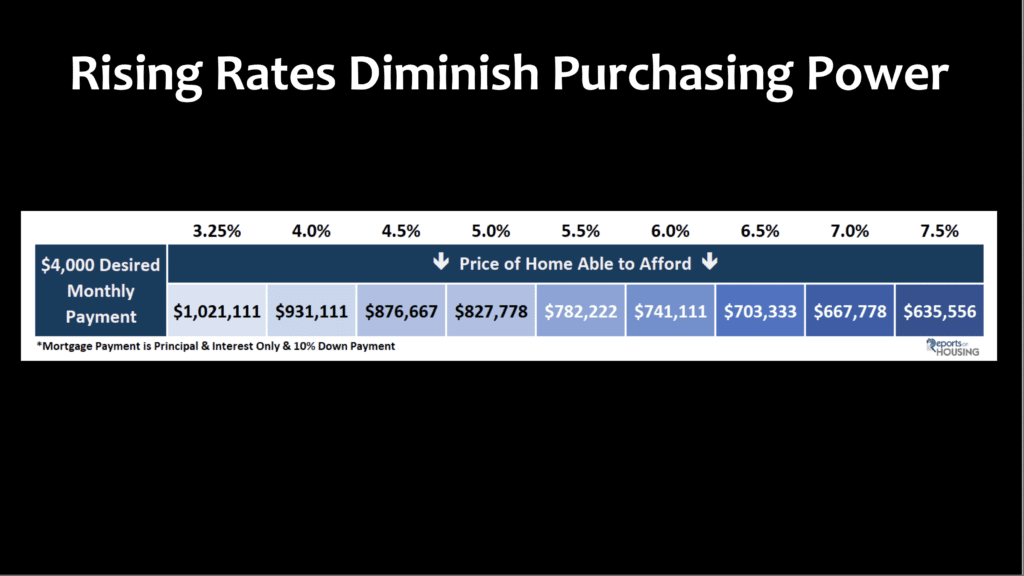

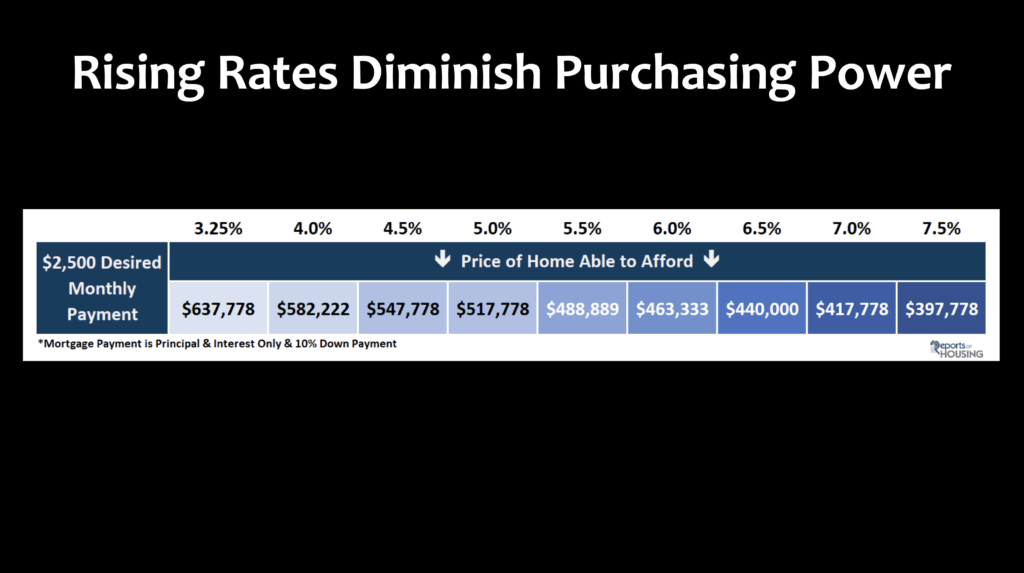

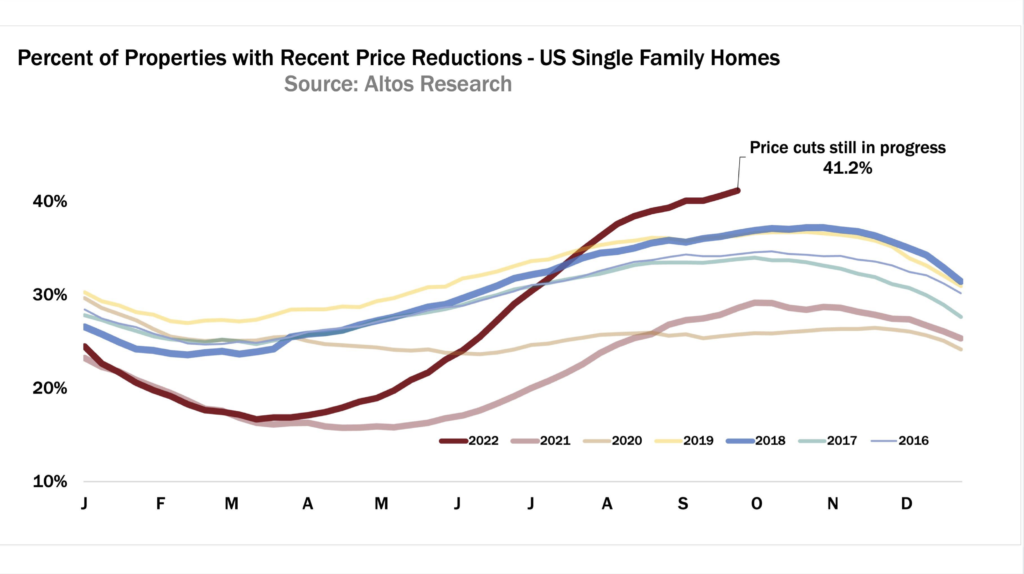

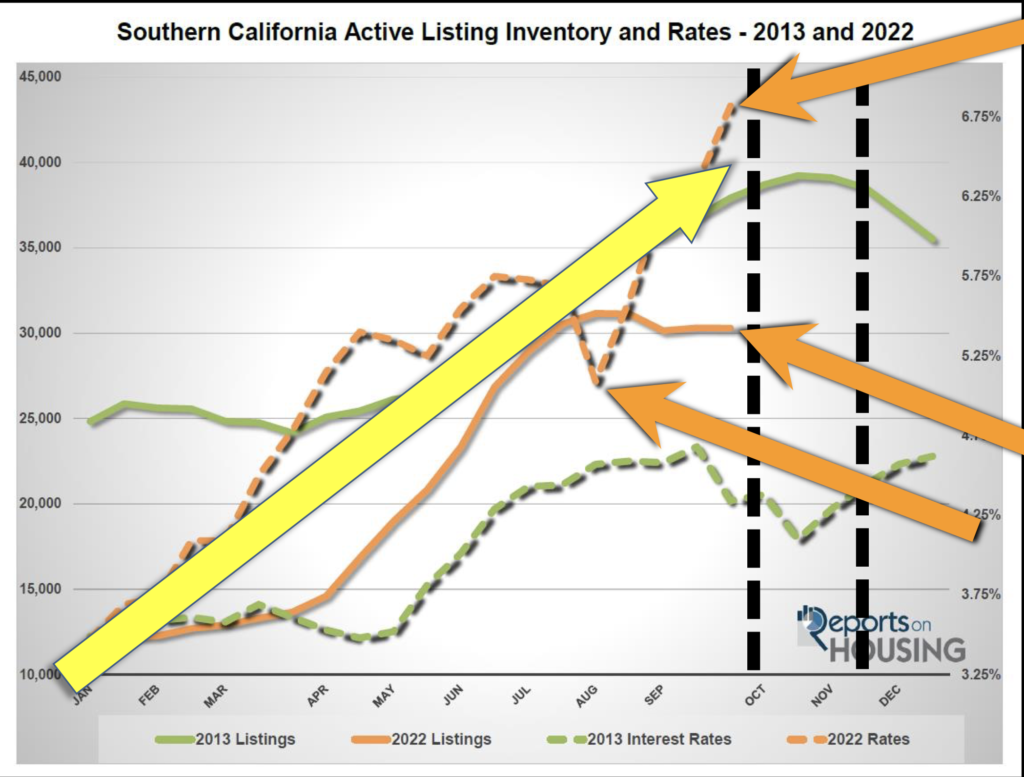

- Asset Values have ballooned due to fed lowing of interest rates consistently over time. Question? Do you really think prices are sustainable at these high levels. It might be reasonable to predict that either prices need to come down, or interest rates need to come back down. I doubt they can both stay this high.

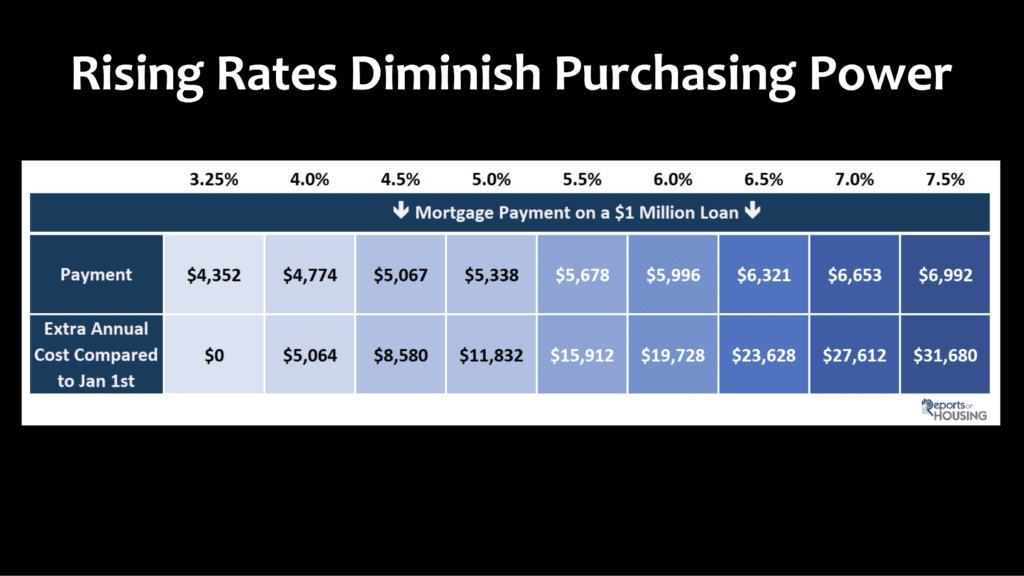

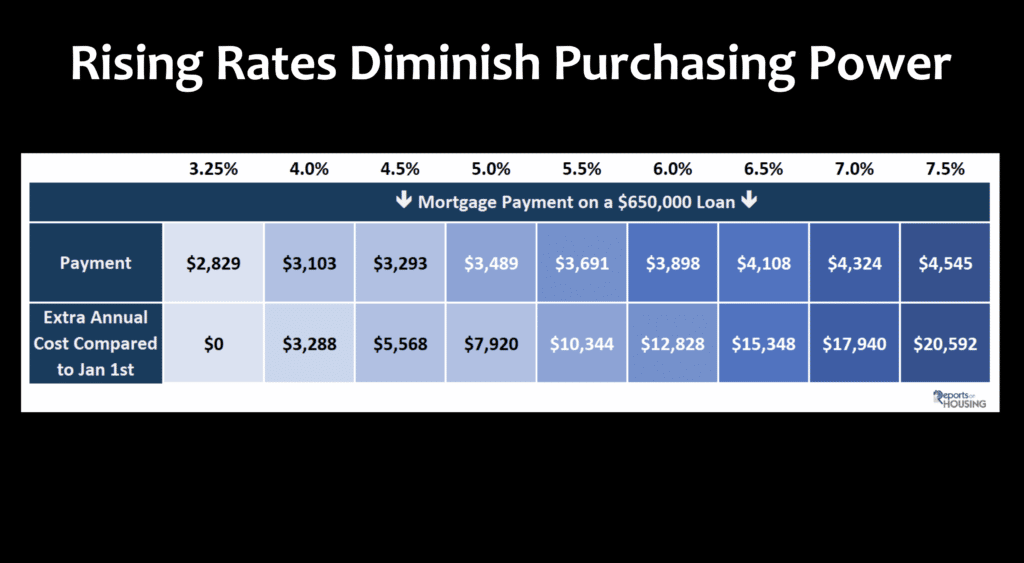

- Homes are simply not affordable at these interes rate levels.

- If you need to sell in the short term, There is a temporary pause in inventory growth that may be an opportunity to exit with proper pricing.

- Waiting for price growth is likely to take quite some time. Even though inventory is still historically low, the market is problematic.

- Planning to take advantage of market conditions if probably a good idea. This crisis may cause a once in a life time opportunity. You can either profit, or not depending on your action and timing.

So what do you need to do now? What opportunities do you need take advantage of? Do you need more cash? Do you need future income? Do you need better interest rates? Or do you just need a better place to live?

I have strategies to deal with all of these situations. Call me for free consultation. John – 949-481-7358